When your business hits a rough patch, it can feel like you’re between a rock and a hard place. But is there a quick way out? One potential solution is a Merchant Cash Advance. In this article, we’ll dive into how emergency Merchant Cash Advance loans work, the process, and if it’s the right fit for your business.

When should you consider an emergency Merchant Cash Advance?

Sometimes, businesses face tough times. Maybe an unexpected expense has thrown a wrench into your cash flow or sales are slower than anticipated. When these challenges arise, you may find yourself asking, “Is emergency Merchant Cash Advance the answer?” While MCAs are a fast and convenient option, they’re not one-size-fits-all.

So when should you consider it?

- Urgent cash flow gaps: If your business is struggling to cover immediate expenses like payroll or rent and you can’t afford to wait for traditional loan approval, an MCA can bridge that gap quickly. Compared to loans, an MCA approval is often completed within 48 hours.

- Seizing time-sensitive opportunities: Imagine you get the chance to buy inventory at a massive discount, but your cash reserves are low. An emergency Merchant Cash Advance loan can help you jump on that opportunity, making it possible to turn short-term financing into long-term profit.

- Limited access to traditional loans: Not every business can qualify for a bank loan, especially if you’ve got bad credit. MCAs generally look at your daily credit card sales, not your credit score, so you can avail it with bad credit as well.

How does Merchant Cash Advance work?

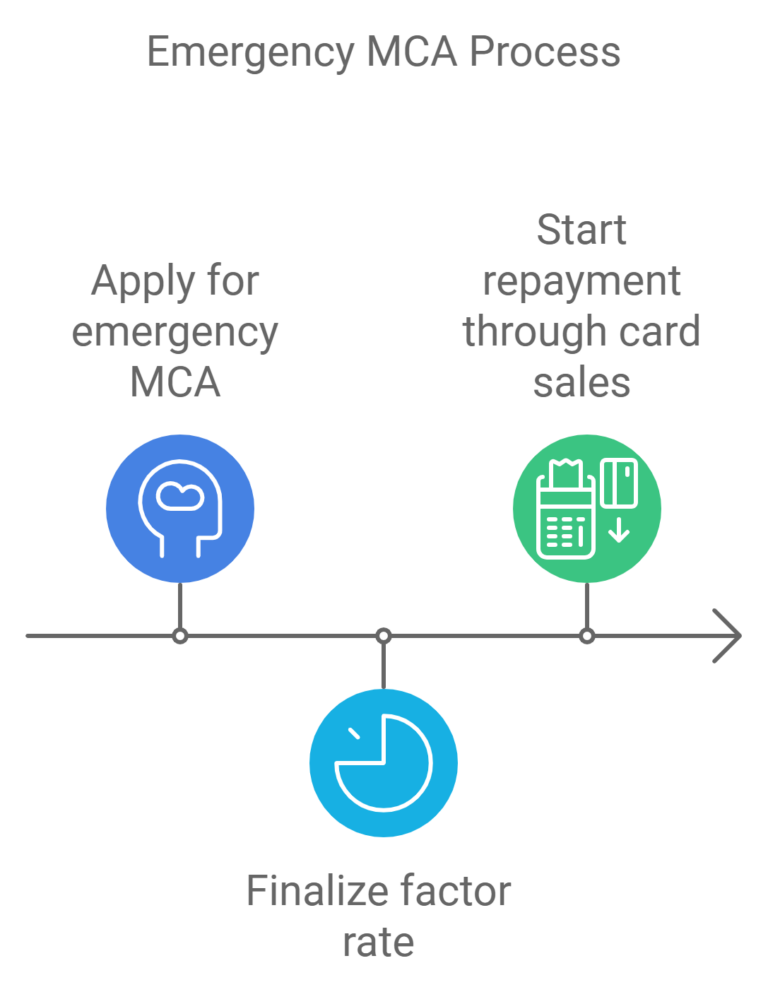

So, how exactly does an emergency MCA loan work? It’s different from a traditional loan – instead of borrowing money and repaying it in fixed instalments, an MCA is an advance on your future sales (specifically your credit and debit card transactions).

Here’s the breakdown:

1. Application process

The good news? It’s fast. Applying for an MCA is often done online, with minimal documentation. Typically, Merchant Cash Advance lenders will ask for 3-6 months of bank statements to assess your sales history. Some companies in the UK can approve your application within hours and have the funds in your account within 24 hours.

2. Factor rates, not interest rates

MCAs don’t come with traditional interest rates. Instead, they charge a factor rate, which is usually a number between 1.1 and 1.5. If your factor rate is 1.3, for example, and you receive a £10,000 advance, you’ll end up paying back £13,000. It’s also important to remember that these rates can lead to an effective annual percentage rate of 40-150%, depending on the speed of repayment.

3. Repayment

Repayment is where MCAs really stand out. Instead of making a fixed payment every month, you repay the advance with a percentage of your daily or weekly sales. This means if the business is booming, you’ll pay the MCA off faster. E.g., if you agreed to pay 15% of your daily sales, and you make £1000 one day, £150 goes to the lender. If you only make £500 the next day, your payment drops to £75.

Do you need a Merchant Cash Advance?

Costs and risks of an emergency MCA loan

While an emergency MCA can be a quick solution, it doesn’t come without significant costs and risks. Let’s dive into the details.

- High costs: One of the biggest drawbacks of MCAs is the cost. Instead of a traditional interest rate, they use factor rates, which doesn’t sound bad until you do the math. If you take a £20,000 advance at a factor rate of 1.4, you’re not just paying back £20,000; you’re on the hook for £28,000. That’s £8,000 in fees right off the bat.

- Daily or weekly payments: MCA repayments are taken directly from your sales – daily or weekly, depending on the terms you agree to. While this sounds convenient, it can actually be a double-edged sword. On good days, the payments might seem manageable. But on low-sale days, it can feel like a lot.

- No boost to credit: In comparison to bank loans, MCAs don’t really help you build business credit since Merchant Cash Advance companies typically don’t report to credit bureaus (this will change in the future, by the way). Even if you repay before the due date (mentioned in the agreement), you gain no incentive.

- Risk of a debt cycle: One of the risks of an emergency MCA loan is falling in the debt cycle. Because these advances are expensive, some businesses end up taking another MCA loan to pay off the first one. This “stacking” can quickly spiral into overwhelming debt.

According to a report by Iwoca.co.uk, most customers pay their MCAs back in around 6 months.

How to qualify for an emergency MCA?

Qualifying for an emergency Merchant Cash Advance loan means you get the funds the same day or after 40-48 hours. But what do MCA lenders look for?

1. Sales history over credit scores

MCAs focus more on your sales history than your credit score. You don’t need stellar credit to qualify, which is great news for businesses that might have had some bumps along the way.

For instance, if your business consistently processes £10,000 in monthly card sales, that’s more important than a credit score of 700.

MCA doesn’t require collateral. Joe Waters, a real estate financing expert, says in a LinkedIn article that this is one of its biggest benefits.

2. Minimum revenue requirements

The good news is, you don’t need to be running a million-pound business to qualify for an emergency MCA loan. Most MCA lenders require a minimum monthly revenue of around £4000-5000, depending on the lender. Some may also have a minimum time-in-business requirement, generally asking for at least 6 months of operation.

3. Basic documentation

You won’t need to gather piles of paperwork like you would for a bank loan. In most cases, Merchant Cash Advance companies will ask for:

- 3-6 months of bank or merchant account statements.

- Basic information about your business (ownership proof, time in operation, etc.)

- Personal identification.

No need for tax returns or business plans, people.

Tips for using an emergency Merchant Cash Advance loan wisely

An emergency MCA loan can be a lifeline for your business, but if you’re not careful, it can quickly become a heavy burden. You might have heard, “it’s easy to grab the tiger by the tail, but harder to let go.” So how do you make sure you’re using this financing option wisely?

- Use it for revenue-generating opportunities: The best way to leverage an MCA is to use the funds where they’ll have the biggest impact on your bottom line. Need to stock up on inventory for the busy season? Or maybe you need an MCA for your salon’s marketing needs. These are good reasons to pull the trigger on an MCA.

- Avoid using it for operational deficits: If you’re thinking about using an emergency Merchant Cash Advance loan to cover basic operational expenses, like rent and utilities, think twice. Sure, it can solve a short-term problem, but it can also put you in a deeper hole. Since the repayments are taken out daily/weekly, an MCA can shrink your cash flow even further.

- Don’t stack MCAs: One of the biggest traps businesses fall into is stacking – taking out another MCA to cover the first one. This can make you fall into the debt cycle.

- Track sales closely: When you take out an MCA, you’re essentially betting on your future sales. It’s important to track them regularly and adjust your spending if you notice a decline. If sales drop, you might need to cut back on non-essential expenses like organising theme parties at the office.

Solve your cash flow problems with an emergency MCA through ComparedBusiness

ComparedBusiness can help you secure emergency Merchant Cash Advance loans from the top lenders in the UK. Just submit your requirements in less than 2 minutes and we will match you with the top financial institutions in the UK. You can pick and choose the best option as per your business requirements.