Common financing options businesses in the UK employ include invoice factoring, traditional bank loans and merchant cash advances. In today’s article, we’ll discuss what MCA is and how to calculate Merchant Cash Advance annual percentage rate (APR). Because unlike loans, it doesn’t include an interest rate but a factor rate.

Let’s go.

What is a merchant cash advance?

A Merchant Cash Advance (MCA) is a financing option where businesses receive immediate capital in exchange for a portion of their future credit card or debit card sales. Unlike traditional loans, where repayment is made in fixed installations, MCA repayments fluctuate – if your sales are low, you repay less, and if your sales are high, you repay more.

These advances are useful for businesses that need quick access to capital but may not qualify for traditional bank loans due to credit or collateral issues. Also, unlike the loans, which include an interest rate, MCA works on a factor rate.

Understanding factor rates in MCAs

The difference between Merchant Cash Advance and a traditional loan is that the interest is calculated using a factor rate rather than an interest rate. The factor rate is a fixed multiplier, usually ranging between 1.1 to 1.5, which determines the total repayment amount. It does not fluctuate with time, meaning the total repayment remains constant regardless of how long it takes to repay the advance.

Let’s say your business takes out an MCA of £20,000 with a factor rate of 1.3. The total amount of repayment would be:

Repayment amount = advance rate x factor rate

= £20,000 x 1.3 = £26,000

While this seems simple, the factor rate alone doesn’t reflect the true cost of borrowing because it doesn’t account for time.

According to Allied Market Research, the global merchant cash advance market was valued at £13.96 billion in 2023.

Do you need a Merchant Cash Advance?

How to calculate merchant cash advance APR

To get a clearer picture of the true cost of a Merchant Cash Advance, you need to calculate the APR. Here’s the step-by-step breakdown:

1. Calculate Total Repayment Amount:

Use the formula:

Repayment Amount = Advance Amount × Factor Rate

For example, if you receive a £100,000 advance with a 1.3 factor rate, your total repayment would be:

£100,000 × 1.3 = $130,000.

2. Calculate the fees:

The next step is to calculate the fees, which are the difference between the repayment amount and the initial advance:

Fees = £130,000 – £100,000 = £30,000.

3. Percentage cost of the advance:

Divide the fees by the loan amount to get the percentage cost:

Percentage Cost = £30,000 ÷ £100,000 = 0.30, or 30%.

4. Annualise the rate:

Multiply the percentage cost by 365 days:

0.30 × 365 = 109.5.

5. Final APR Calculation:

Finally, divide the annualised percentage by the number of repayment days. If your MCA is to be repaid in 9 months (270 days), the APR would be:

109.5 ÷ 270 = 40.5% APR.

This number gives you a clearer idea of how expensive the MCA is annually compared to other financing options.

Additional costs of an MCA

While MCA is appealing for their quick access to capital, it might come with additional fees that can increase the total cost of Merchant Cash Advance. Here are the key additional costs to watch for:

- Application fees: Some MCA providers may charge an origination fee to process the advance. This can range between 1% and 5% of the advance amount and is deducted upfront from the funds you receive.

- Processing fees: These fees are sometimes attached to the funding amount as well. They appear in the form of set amounts, or else a small percentage of the advance, and can be hidden as part of the factor rate.

- Late payment penalties: Although MCA repayments are based on a percentage of daily sales, but sometimes, if the repayments are not possible due to low sales or account issues, they can result in penalties.

- Other hidden fees: Some MCA providers may be charging additional fees like processing fees for credit card transactions and account maintenance fees.

It is because of these fees that it’s necessary to request a full breakdown of everything to do with the advance in order to avoid surprises.

Why is it important to know the APR of an MCA?

Knowing the APR of an MCA is important for understanding the true cost of borrowing. MCAs use factor rates, which can make the cost seem lower at first glance. However, when you annualise the repayments, the APR can be much higher than it initially appeared, often exceeding 40%. By calculating the APR, businesses can better compare MCAs to other financing options like receivables financing, grants or SBA loans.

While an MCA may seem more attractive because of its quick approval and flexible repayments, understanding its APR allows you to determine if the costs are in line with your business’s cash flows and growth potential. According to financial experts, most businesses do not even consider the effective APR and therefore end up overpaying by a factor of several times more than under a traditional loan.

Techniques to achieve a low Merchant Cash Advance APR

- Improve sales consistency: Lenders prioritise businesses with steady sales, as it signals lower risk. If you can manage to demonstrate consistent revenue, especially through credit card transactions, it can help you negotiate better factor rates.

- Negotiate the factor rate: Always negotiate with MCA providers to reduce the factor rate. Even small reductions (e.g., from 1.4 to 1.2) can significantly lower the total repayment amount and thus the APR.

- Shorten the repayment period: If you have a regularly high sales volume, then shortening the period will be of good advantage as it will reduce the annualised rate. You might have to pay higher daily/weekly amounts, but the overall cost of capital will be less.

Pros and cons of merchant cash advances

Let’s now run a comparison of the potential of Merchant Cash Advance in terms of its pros and cons.

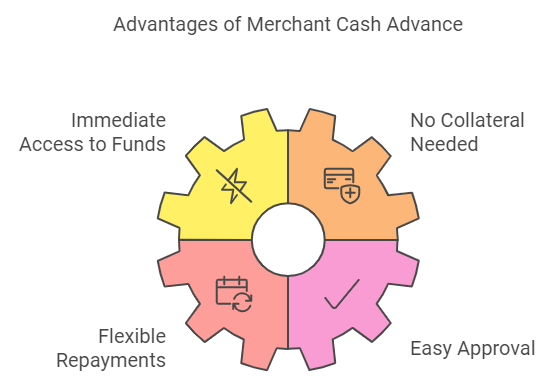

Pros

- Immediate access to funds: MCAs provide businesses with fast access to cash, even the same-day funding. It’s a great option for companies facing urgent financial needs, such as unexpected expenses.

- No collateral needed: Unlike traditional loans, MCAs are unsecured, meaning businesses don’t need to put up personal or business assets as collateral.

- Flexible repayment scheme: MCAs are tied to a percentage of daily or weekly credit card sales, so if your business has a slow day, you pay less.

- Easy approval: MCAs are relatively easy to get approved compared with conventional loans, since a great deal of weight is placed on daily credit card sales rather than on credit score or business history.

Cons

- High cost of capital: MCA can be expensive with APRs that go up past 60%. Factor rates and fees pile up to push the total repayment amount considerably higher in some cases.

- Impact on cash flow: Although repayments are flexible, they remain connected to daily or weekly sales. This can take a significant toll on your cash flow, especially when business is slow.

- Lack of regulation: MCAs are not regulated by the Financial Conduct Authority (FCA) of the UK. This leads to variations in terms and fees, and borrowers might lack the same protection they would with traditional lending.

Want MCAs with cost-effective APRs? ComparedBusiness has you covered!

ComparedBusiness can help you secure merchant cash advance funding from the top vendors at affordable APRs in the UK. Just submit your requirements in less than 2 minutes and we will match you with the top financial institutions in the UK. You can pick and choose the best option as per your business requirements.

FAQs

If you take a £50,000 MCA with a factor rate of 1.4, you’ll repay £70,000. If the repayment period is 180 days, the APR can be calculated as (0.4 x 365)/180 = 81% APR. This shows how MCAs often result in high APR.

The average APR for an MCA typically ranges from 40% to 120% for businesses in the UK. The exact APR depends on the factor rate and the repayment period. In order to get a better APR, you should look for a shorter repayment period.

Merchant Cash Advance is a viable option for businesses needing fast cash and flexible repayments but comes at a high cost generally. They are ideal for short-term needs, e.g. sudden expenses such as disaster control.