All businesses struggle to maintain their cash flow at some point in their operations. These shortages can be caused by a range of factors, such as a slow business season or delayed payments. Whatever the reason may be, what matters most is how the business solves the cash flow crisis. Out of the many financing options available to bridge the gap between expenses and cash resources, a merchant cash advance is one possible solution.

What is a Merchant Cash Advance?

Merchant cash advance (also known as merchant funding) is a financing solution that provides quick funds to a business in exchange for a fixed portion of its future card sales. Unlike standard business loans, the MCA repayments are not based on a fixed amount, but a fixed percentage of a business’s daily or weekly card sales. This provides flexibility in repaying the MCA loan because it adjusts according to a business’s sales volume, so any fluctuations are accounted for.

While an MCA may seem like the ideal solution to a business’s financial problems, the keyword here is temporary. If not handled responsibly, an MCA can lead to major financial issues. In a severe case, a business might find itself in an MCA default. In this blog, we will explain what it is, how to recognise the warning signs, and share practical strategies to help prevent it.

Understanding MCA default: What does it mean?

In financial terms, an MCA default is often mistakenly considered synonymous with simply missing repayments, but that is not always true. A more correct definition is that an MCA default happens when a business breaches the terms of the agreement made with the provider. MCA repayments are indeed based on a fixed percentage of sales volume, meaning a business repays less when the sales are low and more during busy times, but that doesn’t make it immune to default.

So how can low repayments lead to default if the structure already accounts for sales fluctuations? This question is valid, and the answer is in the MCA contract terms. Most providers evaluate the sales history of a business when approving its application and often include a minimum repayment clause based on that history. But if the future sales turn out to be consistently lower, it may raise red flags.

This could happen for several reasons: a business might have

- Overestimated its sales data during the application.

- Rerouted sales to another account to reduce repayments.

- Or there’s simply a genuine decline in sales.

Regardless of the cause, the result is the same: the provider sees it as a violation of the contract, and that results in an MCA default.

Later in the blog, we’ll go deeper into the causes of MCA default and how businesses can avoid them. For now, the main takeaway is understanding what an MCA default truly means.

Do you need a Merchant Cash Advance?

What happens in an MCA default?

The consequences of an MCA default can be severe, and both the current cash flow of a business and its long-term prospects are affected. Once a default is confirmed, the MCA provider may respond by taking legal action or adding overdraft or penalty fees, which only worsen the financial problems.

These aggressive collection tactics can lead to bank account freezes, lawsuits and even personal assets being at risk if the agreement includes a relevant clause. In addition to that, an MCA default can also damage a business’s credit score. This makes it harder for it to get future access to loans, invoice factoring or other financing options.

Early warning signs of an MCA default

Knowing the early signs of an MCA default can help your business take preventive measures. One of the most common signs is consistently lower sales volume. If your sales sink and stay low, it’s time you assess whether you can still manage the MCA’s daily deductions.

Another early indicator of an MCA default is ongoing cash flow issues. If your merchant cash advance is contributing to funding issues rather than solving them, something is not right. This brings us to our next risky sign of an MCA default, which is taking an MCA loan to cover the repayments of another one. If you’re using one advance to pay off another, you’re entering an expensive debt cycle.

Finally, if you’re unclear about your daily repayment amounts or how much you owe, it’s a sign that you lack control over your MCA. This lack of clarity can lead to missed payments and ultimately, a default.

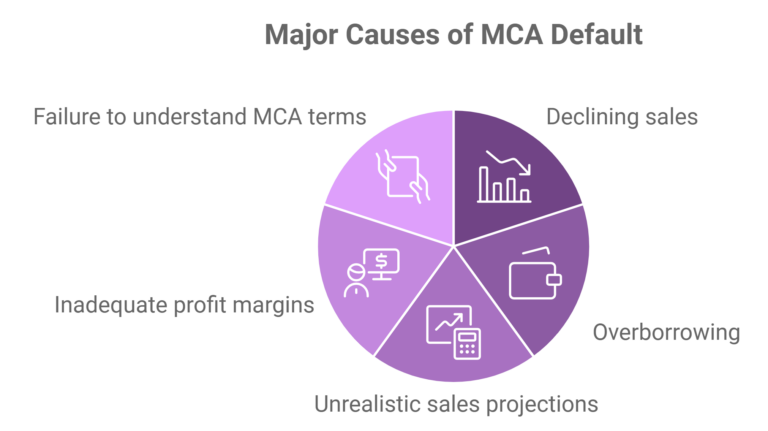

Major causes of MCA default

Let us discuss the main reasons behind an MCA default.

1. Lower sales volume

The most common cause of an MCA default is a significant drop in sales. That is because you’re making the repayments with your daily or weekly revenue, and a fall in sales can very quickly lead to missed or delayed repayments.

If your business doesn’t plan for the seasonal fluctuations in cash flow, there is a higher chance of an MCA default. To counter this, businesses should create a realistic sales estimate and account for seasonal dips and any unexpected downturns.

2. Too many MCAs to handle

Taking too many MCAs or borrowing more than your business can handle is another fast track to default. It increases the pressure on revenue streams and can turn cash advances into a debt spiral, leaving your business with insufficient funds to convert multiple repayments.

3. Unrealistic sales projections

Optimism is a great asset for business owners, but overestimating future sales can be dangerous when taking an MCA. If sales don’t meet the projections you used to justify taking on the advance, you’ll find yourself unable to make consistent repayments, which will trigger an MCA loan default.

4. Inadequate profit margins

When businesses have thin profit margins, even a slight increase in costs can lead to financial strain. If the profits aren’t enough to cover the daily MCA deductions along with operational expenses, default becomes almost inevitable.

For example, a coffee shop operating on thin margins may use an MCA to boost capital for a new marketing campaign, but if the campaign doesn’t result in higher sales, those daily repayments will eat into its already limited profits.

5. Failure to understand MCA terms

Some businesses enter MCA agreements without fully understanding the terms, including the costs, repayment percentages and additional fees. Without a clear understanding of how repayments will affect daily cash flow, you can quickly become overwhelmed. This is why it’s integral to get help from an experienced accountant and financial planner.

How to avoid merchant cash advance default?

Avoiding an MCA default requires careful planning and proactive management. It’s not rocket science, but without a strategy, businesses can quickly find themselves in hot water. Here are some actionable ways:

1. Evaluate MCA terms carefully

Before taking out a normal or emergency Merchant Cash Advance, it’s crucial to read the fine print. Repayment terms, fees and the percentage of sales taken daily or weekly. A great deal might not be so great if it stains your cash flow. Ask yourself, “Can I manage these deductions during slower sales periods?”

2. Monitor cash flow regularly

Maintaining healthy cash flow is key to avoiding default. Regularly monitor your incoming revenue and outgoing expenses, making sure you always have enough to cover the MCA repayments.

It’s not enough to just pay attention during good sales months – keep an eye on it year-round. For example, an e-commerce store might see a spike in sales during a Black Friday promotion, but poor cash flow management after the season could result in repayment issues.

According to an article in Zippia, bank studies have shown that almost 82% of businesses close due to cash flow issues.

3. Negotiate MCA terms

What’s the biggest advantage of MCA? The flexible repayment structure. Right? But they can become a roadblock in your cash flow as well. If the initial terms of your MCA seem too aggressive, don’t hesitate to negotiate. MCA is not regulated in the UK (at the time of writing) so you can always discuss possibilities with providers.

Many reliable MCA providers in the UK will be willing to adjust the percentage or offer more flexible repayment plans. You don’t need to sign the first contract put in front of you.

4. Avoid taking multiple MCAs

It can be tempting to stack multiple MCAs, especially when cash is tight, but this is a dangerous strategy. Taking on several advances at once increases your repayment obligations and raises your probability of default. It’s like digging yourself into a deeper hole.

If you find yourself needing additional financing, consider other options like a business loan or a line of credit.

5. Consult a financial advisor

Sometimes, a fresh perspective can make all the difference. Consulting with a financial expert allows you to evaluate your overall health and assess whether an MCA is the right choice for your business. They can also help you structure a realistic repayment plan to reduce the risk of default.

Alternatives to taking out an MCA

While an MCA can provide quick access to cash, it’s always good to have other options in sight as well. If you’re looking for ways to boost capital while avoiding the risks of MCA loan default, here are some alternative financing options:

1. Business loan

Lower risk of default as they have a fixed repayment amount that isn’t dependent on your daily or weekly sales.

2. Line of credit

Draw as much or as little as you need and only pay interest on the amount you use. A line of credit ensures you’re not locked into high repayment percentages like with merchant funding.

3. Invoice financing

In invoice financing, there is a lower probability of default since repayments are tied to the collection of outstanding invoices.

4. Crowdfunding

A creative alternative to traditional small business financing. It involves raising money from backers who believe in your product or service. In many cases, you won’t owe them anything other than the product/service.

Avoid the risk of MCA default by connecting with reliable providers with ComparedBusiness UK

ComparedBusiness UK helps you secure merchant cash advance funding from top lenders in the UK, offering flexible terms. Just submit your requirements in less than 2 minutes, and we will match you with them. You can select the best option according to your business requirements. This service costs you no money.

FAQs

An MCA default occurs when a business breaches the terms of its agreement with the MCA provider. This doesn’t always mean missed payments. Even if you’re repaying based on a percentage of sales, default can happen if you fail to meet a minimum repayment clause or reroute sales to avoid deductions.

If you default on an MCA, the consequences can be serious. The provider may implement extra penalty fees, freeze your business accounts, or even take legal action. In some cases, if your contract includes personal guarantees, your assets may be at risk. A default could also negatively impact your business credit score.

Some of the early warning signs include:

- A consistent drop in card sales.

- Ongoing cash flow issues.

- Using one MCA advance to repay another.

- Not knowing how much your daily deductions are.