A restaurant may require funding to manage its cash flow for a variety of reasons. The need for funding can arise from various factors, including a slow sales season, financial constraints, payroll requirements, hiring new staff, or undertaking projects such as expanding the menu, opening a new branch, upgrading kitchen equipment, refurnishing the space, or implementing new technologies into the system.

All the above reasons have one thing in common: they create a cash flow gap in a restaurant that needs to be filled in order to keep the usual business operations running. In such situations, a merchant cash advance can be a smart option for a restaurant to get quick financial assistance and sort out its finances on time.

In this blog, we will explain the concept of merchant cash advance in detail, why restaurants may need it, and how it can offer a flexible financing solution based on a restaurant’s card sales.

What is a merchant cash advance?

A merchant cash advance or merchant funding is a financing option that allows businesses to access instant capital by selling a segment of their future card sales. It is specifically tied to card transactions, and other payment options are typically not included in the agreement. It’s a way for businesses to secure funding without taking a loan in a traditional way. Instead, the repayments are paid through automatic weekly or monthly deductions from card sales taken as a fixed percentage.

Do you need a Merchant Cash Advance?

Why restaurants opt for a merchant cash advance

The restaurant industry constantly evolves with new trends and consistent pressure to maintain quality service. This is why many restaurants turn to merchant cash advances to manage their cash flow and invest in their business. Let us discuss 5 reasons why MCA appears to be an attractive financing option for restaurants.

- Flexible repayment structure: A major advantage of a merchant cash advance is its flexible repayment structure. Instead of paying a fixed amount every month, the repayments are made as a fixed percentage of daily or weekly card sales. This structure allows businesses to make smaller payments on days with fewer card transactions, while larger payments occur on busier days.

- MCA is not a loan: A business sells a portion of its future card sales with MCA, and no borrowing process is involved. Therefore, the business’s records do not register it as a loan.

- No collateral needed: Restaurants are not required to provide collateral to access funding with MCA. Instead, the risks associated with a restaurant are tied to its profitability and average monthly card sales.

- Speed of the funding: Another important factor is the speed of MCA funding. In the fast-paced restaurant industry, waiting weeks to get approved for a bank loan is not always feasible. With an MCA, restaurants can access funds within 24-72 hours of applying and clear their expenses on time.

- Lenient credit score requirements: It is difficult for many small or new restaurants to meet the strict credit score requirements of traditional loans, which becomes a struggle paired with the long approval processes. However, MCA focuses more on daily card sales than credit scores. This makes them accessible to a wide range of restaurant owners.

3 Flexible MCA options for all restaurants

MCA doesn’t appear as a loan on a business’s records. Instead, it is recorded as selling your future accounts receivable, with the factor rate based on the profitability of your restaurant. The short-term nature of an MCA offers excellent flexibility for restaurants, and there are various options available depending on your business’s needs.

1- Merchant cash advance with no credit check: Restaurants seeking instant funds without undergoing hard credit checks can find a relevant financing solution.

2- Same-day merchant cash advance funding: Restaurants looking to secure urgent funds, preferably within 24 hours, should consider same-day MCA funding. We recommend you apply during the early office hours to expedite the application process and increase your chances of approval.

3- Funding for merchant cash advances for restaurants with bad credit: Restaurants that do not qualify for traditional bank loans due to bad credit (typically lower than 600) can get access to capital with different MCA options available.

Cost of merchant cash advance for restaurants

The total repayment amount owed by a restaurant to the MCA provider is calculated using a factor rate. It’s the fee paid by the restaurant in exchange for receiving the MCA services. A factor rate is typically expressed as a decimal or pennies per pound borrowed. It can be negotiated, and both the MCA provider and the restaurant mutually decide on it before finalising the agreement.

For example, a factor rate of 1.3 (30%) means that for every £1,000 borrowed, your business pays back £1,300 from your future card sales.

Restaurant merchant cash advance loan example

Let us look at a real-world example to understand the working of a merchant cash advance better. Imagine a small restaurant in London that needs £30,000 to upgrade its kitchen equipment and renovate the entrance to attract more customers. They opt for an MCA. The provider offers them £30,000 in exchange for £39,000 of future credit card sales, with a factor rate of 1.3. The restaurant agrees to repay 15% of their daily card sales until the full £39,000 is repaid.

If the restaurant brings in £2,000 in card sales on a day, £300 is automatically deducted toward the MCA repayment. So, there are no fixed monthly repayments, but rather a fixed percentage that adjusts according to the total sales.

According to a report by Wifi Talents, the approval rate for merchant cash advances is around 90%.

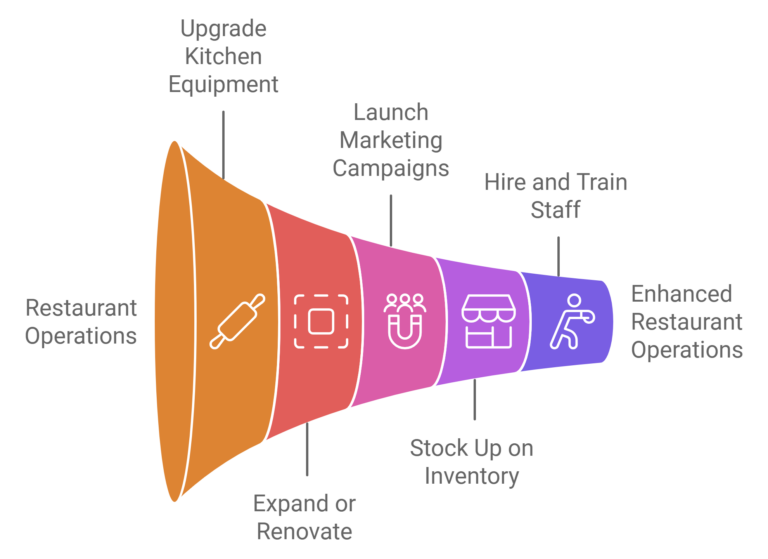

How can restaurants use merchant cash advance

1. Upgrade kitchen equipment

Restaurants often need to upgrade their current equipment with better and more specialised kitchenware to expand their menu and introduce new items. Such modern appliances can support a variety of dishes, save energy, and increase productivity, so more customers can be served in less time. Also, older kitchen tools tend to wear down over time and may no longer meet food safety standards. For all these reasons, a restaurant can use the funds from an MCA to clear expenses upfront and then repay them later through daily or weekly deductions from its card sales.

2. Expand or renovate locations

Customer preferences and popularity trends change over time. To remain competitive, many restaurants change their interior design, upgrade furniture, or even completely revamp their space to create a fresh atmosphere. With MCA funding, restaurants can cover the costs of renovations without slowing down their daily operations.

3. Launch marketing campaigns

Word of mouth can only take you so far. Restaurants need to actively market themselves, and with MCA funding, they can invest in social media ads, email marketing or even influencer collaborations. A well-timed campaign can fill seats during slow periods or promote a new menu item. This is one of the main reasons why salons take MCA as well.

4. Stock up on inventory

From fresh produce to speciality ingredients, maintaining an ample inventory is vital for any restaurant. With flexible funding from an MCA, restaurants can stock up on bulk orders or seasonal ingredients without worrying about cash flow constraints. This way, they can keep the menu fresh and avoid running out of key ingredients when demand spikes.

5. Hire and train staff

As your restaurant grows, so does the need for skilled staff. Whether it’s hiring an experienced chef or training your current team on new culinary techniques, an MCA provides the funds necessary to invest in your workforce.

Applying for a restaurant merchant cash advance loan

When applying for a restaurant Merchant Cash Advance, the process is typically simple and much quicker when compared with loans. Here’s what’s usually required:

1. Consistent credit card sales

Reliable MCA providers look at restaurant’s daily or monthly credit card sales to determine eligibility. A steady stream of card transactions is crucial because this will be used to calculate the advance and repayment.

2. Bank and credit card processing documents

Lenders will want to see 3-6 months of bank and credit card processing statements. These documents give a clear picture of the restaurant’s cash flow, sales volume and overall financial health. Other information may include a business license, tax identification number and ownership information.

3. Reviewing terms and factor rates

After submitting the necessary documents, the MCA provider will evaluate your application and offer an advance amount along with a factor rate, typically between 1.2 to 1.5.

According to a report by Wifi Talents, around 60% of small businesses that use MCAs are restaurants.

How to choose a reliable MCA provider for restaurants

1. Transparency and full disclosure

The first thing to look for in an MCA provider is transparency. A reputable company will clearly outline the factor rates, fees and repayment terms upfront. Hidden fees can quickly turn what seems like a good deal into an expensive burden.

For example, some providers may charge administrative fees. Don’t get caught off guard – always ask for a full breakdown of costs.

2. Industry expertise

Choosing a provider that understands the restaurant industry can make a world of difference. Restaurants have unique cash flow patterns so working with a provider that specialises in restaurant MCAs ensures the terms and repayment schedules are aligned with your business.

3. Reasonable factor rates

Factor rates can range anywhere from 1.2 to 2, and this number will greatly impact the total repayment amount. A higher factor rate means you’ll be paying back significantly more than the amount advanced. It’s important to shop around and compare rates from different providers to ensure you’re getting a fair deal.

Some MCA companies may charge a higher factor rate but offer more flexibility in repayment. Weigh these pros and cons when making a decision.

4. Flexible repayment terms

One of the biggest advantages of MCA is the flexibility in repayment, but it only works if the holdback percentage is reasonable. A high rate like 20% can dent your cash flow, making it difficult to cover operating costs such as payroll and inventory.

5 Customer support and reputation

Last, but not least, customer service is vital when choosing an MCA provider. You want to work with a company that offers responsive support and is available to answer your questions throughout the process. Check reviews, ask other restaurant owners for recommendations, and make sure the company has a solid reputation in the market.

Explore Top MCA Options For Your Restaurant In The UK with ComparedBusiness UK

ComparedBusiness UK helps you secure merchant cash advance funding for restaurants from the top providers in the UK. Just submit your requirements in less than 2 minutes, and we will match you with the top lenders that will provide flexible MCA options for your restaurant business. You can then pick and choose the best option.

FAQs

MCA offers rapid funding through its quick application process and instant capital providence. Depending on the provider, funds can be accessed within 24-72 hours of applying.

No, a merchant cash advance is different from a traditional bank loan in a number of ways. It does not involve borrowing cash with an interest rate; instead, it just means selling a part of your future card transactions. Unlike a bank loan, it does not require security collateral or a fixed repayment span. The advance is repaid daily or weekly according to a fixed percentage of the total sales at that time, so the repayment span varies. Due to these factors, it does not appear as a loan in a restaurant’s accounting records.

No, there are no such restrictions. The money from MCA can be used for marketing, restocking inventory, renovating, upgrading kitchen equipment, paying employees, or covering other costs.