Think for a moment about losing revenue not because of a genuine refund but due to fraudulent claims. It’s frustrating, right? For business owners like you, one such claim is the chargeback fraud, which is more than a nuisance; it’s a silent profit killer.

According to chargeback fraud statistics, businesses lose a lot annually to these deceptive practices. Whether it’s friendly fraud or deliberate scams, the financial impact is huge. But what exactly is chargeback fraud, and why does it matter to your business?

What is chargeback fraud?

Chargeback fraud, often called friendly fraud, happens when a customer disputes a legitimate purchase, expecting that the bank will reverse the payment. While the chargeback process is meant to safeguard consumers, some of the shoppers can use it to hurt your busines.

The process of chargeback is as follows:

- A customer disputes a purchase.

- The customer’s bank (issuing bank) listens to the claim and temporarily reverses the transaction. This means the money is pulled out of the merchant’s account and held until the dispute is resolved.

- The merchant is notified about the chargeback and asked to provide evidence that the transaction was legitimate.

- The payment processor and the card network might also get involved in the process.

Based on the evidence, the issuing bank decides who wins the dispute. If the bank sides with the customer, the merchant loses the payment, and not only that, they pay the chargeback fee.

In a chargeback fraud, the customer makes the dispute falsely – maybe by saying they never received the product or the transaction was not authorised.

Why is it a big deal? Because every chargeback fee (be it £15 or £25) can eat the profits of your business. And too many disputes can signal risk to payment processors, which can lead to account termination in worse scenarios.

Global chargeback & fraud statistics

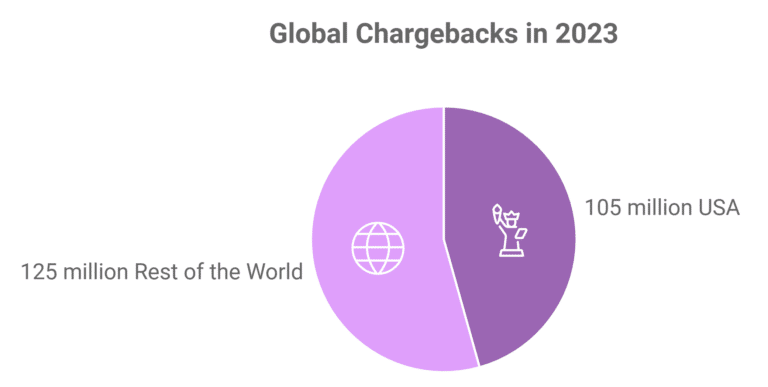

- There were more than 230 million chargebacks globally in 2023. USA accounted for 105 million of them (Chargeback.io).

- Total chargeback costs exceeded $117 billion/£93.4 billion in 2023 (Chargeback911).

- 75% of the merchants reported an increase in friendly fraud instances in 2023 (Chargeback911).

- The most common reason for chargebacks was fraud, which accounted for 34% of the chargebacks. “Product never arrived” was 2nd and “wrong product” was 3rd (Clearly Payments).

- Brazil recorded a chargeback rate of 3.84%, while that of the US was 0.47% (Chargeback911).

- Card-not-present fraud was the most common of all UK card frauds in 2022, amounting to 2.21 million cases, which contributed to a loss of £396 million (Merchant Savvy).

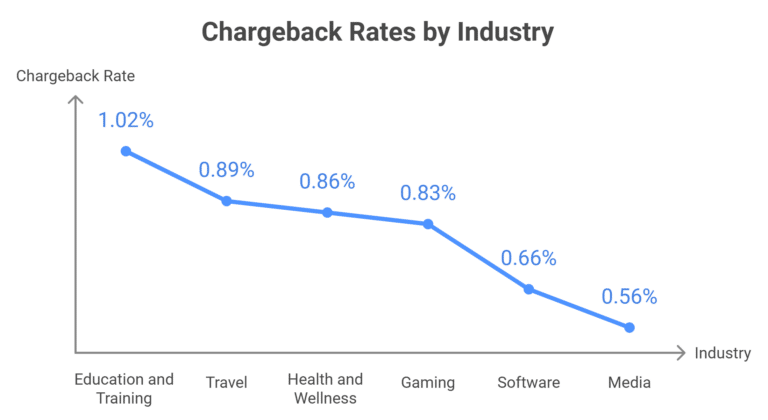

Chargeback rates by industry statistics

Below is a compilation of chargeback statistics for global markets.

- Education and training: It faced the highest chargeback rate of 1.02%.

- Travel: It experienced a chargeback rate of 0.89%.

- Health and wellness: It recorded a rate of 0.86%.

- Gaming: It came in 4th with 0.83%.

- Software: Software stood at the 5th position with a rate of 0.66%.

- Media: This industry experienced a rate of 0.56%.

(via Swipesum).

Here are the common factors that contributed to these chargebacks:

1. Education:

- Dissatisfaction with training materials.

- Lack of clear refund policies or delayed responses. This led to disputes which escalated into chargebacks.

2. Travel:

- Flight or hotel cancellation over refund eligibility.

- Complaints about service quality such as delayed departures or overbooked accommodations.

3. Health and wellness

- Dissatisfaction with product effectiveness, such as supplements or fitness plans.

- Confusion over auto-renewing subscriptions for services like wellness programs.

4. Gaming:

- Unauthorised purchases.

- Complaints about in-game purchases not being delivered.

5. Software:

- Not satisfied with the value/utility of purchased software.

- Misunderstanding about billing cycles for SaaS subscriptions.

6. Media:

- Unmet expectations in streaming.

- Unauthorised account access which led to disputed charges.

Financial impact of chargeback fraud on businesses

The effects of chargeback frauds are prominent – Businesses had to endure losses of about $20 billion/£15.9 billion as a result of chargeback fraud in 2021 alone (Juniper Research). Now, let’s discuss some of the consequences of chargeback fraud in detail.

1. Direct financial losses

Chargebacks aren’t just about refunding a customer; they involve additional fees, typically in the range of £15-25. These fees, imposed by payment processors or banks, can quickly add up if the businesses experience a high volume of disputes.

This type of loss is a direct hit to the bottom line. And mind it, a report found out that 86% of chargebacks are probable cases of friendly fraud (Chargeback911).

2. Increased operational costs

Handling chargebacks is a time-consuming process that involves collecting evidence, e.g. proof of delivery and receipts, submitting it to the issuing bank, and responding to follow-up queries. This diverts your resources from other critical business activities and increases operational expenses.

According to a report, chargebacks affect 6 out of every 1000 transactions, especially in the e-commerce industry (Clearly Payments).

3. Higher merchant account fees

When a business’s chargeback rate exceeds the acceptable threshold (normally 1% of total transactions), it’s labeled as high risk by the payment processors and card networks. This results in higher transaction fees, and stricter terms, which does what? Reduces flexibility in managing payments.

It can also impact the cash flow as payment processors may delay the funds to mitigate their own risk.

4. Reputational damage

Frequent chargebacks signal to customers and stakeholders that a business might be unreliable or untrustworthy. This perception can deter your future customers, which can lead to lost sales and a decrease in long-term revenue.

Preventive measures for UK businesses

Implementing preventive measures is crucial to reducing chargeback fraud risks.

1. Implement a fraud detection system

Fraud detection tools use transaction data to identify patterns that indicate potential fraud, e.g. high-value purchases or mismatched IP addresses and shipping locations. Combining such tools with machine learning creates a dynamic system which is capable of reducing these frauds.

For example, Visa prevented $40 billion/£31.8 billion worth of fraudulent transactions in 2023 through technology (Reuters).

2. Enhance customer verification processes

Verify every customer that comes into your systems. How?

Multi-factor authentication (MFA) is the first thing. It adds an extra layer of security because it prompts the customers to use 2 methods of identification, which are a password and a one-time code sent via SMS or email.

Another process you can implement is the address verification system (AVS) and CVV check. This ensures the cardholder’s information matches the transaction.

3. Monitor chargeback data

Regularly reviewing chargeback data also helps your businesses identify patterns and adjust strategies to prevent future disputes. This includes information like chargeback rate and dispute reasons, which you can get from your payment processor.

With a reported increase of 19% in chargeback fraud between the years 2022 and 2023, this constant monitoring has become the need of the time.

Bottom line

Protecting your business from chargeback fraud starts with proactive measures like fraud detection and strong customer verification.

We know it’s a likely danger to your revenue. That’s why we recommend collaborating with your payment processor and analysing chargeback data to reduce the tendency. Take action today to stay ahead of fraud!

ComparedBusiness connects you with reliable card machine solutions

We are experts at providing businesses like yours with top credit card processing solutions. Our proprietary system processes your details and links you with relevant service providers so you don’t have to do the hard work.

Just submit your business details in less than 2 minutes and we will get back to you with quotes from the list of top card machine providers in the UK.