Invoice factoring is a popular financial tool that helps businesses maintain steady cash flow by selling their invoices to a factoring company. It’s especially useful for companies needing an immediate cash injection without waiting for clients to pay their invoices. However, to ensure accurate financial reporting, it’s crucial to understand how to record factoring transactions properly.

Recording these transactions correctly helps businesses track their financial health, manage debt and prepare for audits.

What is invoice factoring?

Invoice factoring or accounts receivable factoring is a financial strategy where a business converts its invoices into immediate cash by selling them to a factoring company. B2B businesses opt for this process because many times, the payment terms extend to 30 or even 90 days. This lag in the payment can cause cash flow problems for them.

Selling the unpaid invoices provides them quick cash, allowing them to cover their costs or invest in growth opportunities without waiting for customers to settle their bills.

Compare Invoice Financing Quotes Today

How does invoice factoring work?

Invoice factoring works in 3 steps:

- Sell the product/service: Sell your goods or services to customers and generate invoices.

- Sell the invoices: Sell your outstanding invoices (accounts receivable) to the factoring company that pays you 70-90% of the invoice value in advance. It then starts collecting payments from your customers while you use that cash for your expenses and investments.

- Receive the remaining balance: Once the factoring company collects all the payments, it advances the remaining balance in your account minus the factoring fee.

Invoice factoring example

Consider a construction company waiting on £50,000 in invoices. Instead of waiting 60 days for payment, they sell these invoices to a factoring company, which advances £45,000 at a 2% fee. When the customers pay the invoices, the factoring company forwards the remaining £4,000 (£5,000 – factoring fee, i.e., £1000).

According to a report published in 2018, almost 45,000 businesses in the UK use invoice factoring.

Setting up accounting for factoring accounts receivable

Companies use factoring to solve cash flow problems. Properly setting up accounting for factored receivables is essential to ensure financial reporting, cash flow tracking and maintaining a clear picture of your business’s cash flow. Here’s how to record factoring in accounting:

The process

- Create a factoring account: Set up a separate ledger account to track the factored receivables. This will help you distinguish between regular receivables and those factored.

- Record the factored receivables: When you factor an invoice, credit your accounts receivable for the full amount and debit the factoring account to reflect the transfer of the invoice.

- Account for cash received: Record the cash received from the factoring company by debiting your cash account and crediting the factoring account. This step keeps your records updated with the immediate cash flow you gain.

- Record the factoring fees: Deduct the factoring fees charged by the factoring company from the factoring account. Debit the factoring fees account and credit the factoring account to reflect the cost of factoring services.

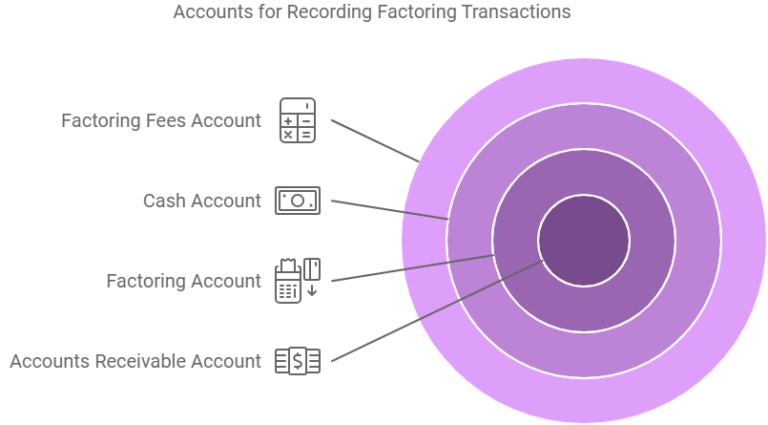

Accounts needed for recording factoring transactions

Factoring accounts receivable requires you to create some accounts.

- Accounts receivable account: This account tracks the outstanding invoices to your business by the customer.

- Factoring account: It is a dedicated ledger that tracks the receivables factored to the factoring company. It also shows the cash received and any remaining balance after customer payment.

- Cash account: This account records all cash inflows and outflows for your business.

- Factoring fees account: This account records the costs associated with factoring services.

What information should I include in the invoice factoring transaction?

When recording an invoice factoring transaction, it’s important to capture all relevant details to ensure accurate financial records. Here are the necessities:

- Invoice number and date.

- Customer details like name and contact information

- Invoice amount.

- Advance received, which is typically a percentage of the invoice amount.

- Factoring fees, which are deducted either from the advance or the final payment.

- Account adjustments, which include credits and debits to the accounts receivable account, cash account, factoring account and factoring fees account.

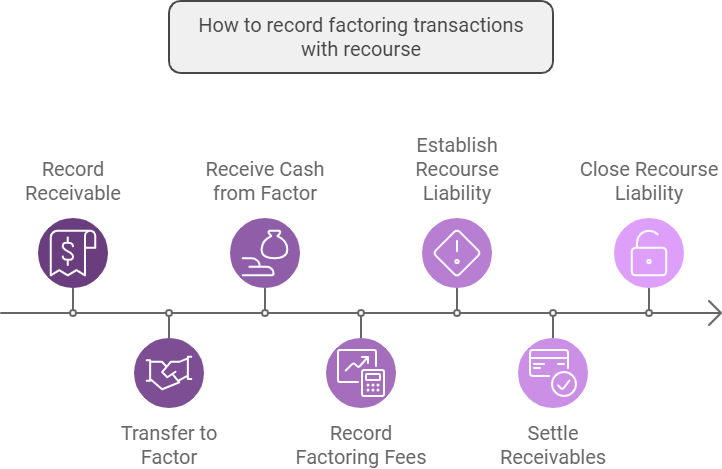

How to record factoring transactions with recourse?

Recording factoring transactions with recourse involves recognising the potential liability that the business may need to buy back the receivables if the customer fails to pay. Here’s the general process:

1. Recording of the receivable:

When you generate an invoice, record the full invoice amount in your accounts receivable account. This entry represents the amount owed by the customer.

2. Transfer to the factor:

When the receivable is factored, remove the receivable from your accounts receivable account and create a new entry in your factoring account to reflect that the receivable has been sold to the factoring company.

3. Cash received from the factor:

Record the cash advance received from the factoring company as a debit to your cash account and credit the same amount to the factoring account. This represents the partial payment for the receivable.

4. Recording the factoring fees:

Deduct the factoring fees from the remaining balance in the factoring account. Record this deduction as an expense in the factoring fees account.

5. Recourse liability:

Create a liability entry for the recourse agreement in a recourse liability account. This amount represents the liability in the business account for the risk associated with this arrangement.

6. Settlement of the receivables:

When the customer pays the invoice, the factoring company will release the remaining funds, minus fees. Record this final payment as a debit to the factoring account and a credit to the cash account.

7. Closing the recourse liability:

Close the recourse liability account to reflect that the potential obligation to repurchase the receivables has been eliminated.

How to record factoring transactions without recourse?

Recording financial transactions without recourse is simpler since the business has no obligation to repurchase the invoices if customers default. The process:

1. Initial recording of the receivables:

As in transactions with recourse, record the invoice amount in the accounts receivable account.

2. Transfer to the factor:

Remove the receivables from the accounts receivable account and transfer them to the factoring account.

3. Cash received from the factor:

Record the cash advance as a debit to your cash account and a credit to the factoring account.

4. Recognition of factoring fees:

Deduct the factoring fees from the factoring account and record them in the factoring fees account.

5. Final settlement:

When the customer pays the invoices, the factor releases the remaining balance. Record it as a debit in the factoring account and as a credit to the cash account.

How to record invoice factoring transactions in Quickbooks?

Quickbooks is one of the most popular accounting software used by businesses in the UK. Here is a brief overview of how to record factoring transactions in Quickbooks.

- Create a factoring account: Create a factoring account under the “Current Assets” category. This account will track the receivables sold.

- Record the invoice: Create the invoice as you normally would in Quickbooks.

- Record the advance payment: Upon receiving the advance from the factor, deposit it into your bank account. Use the factoring account as the offsetting entry to reflect the transfer of the receivables to the factor.

- Record the factoring fees: Create a “Journal Entry” of the fees. Debit from the factoring fees account and credit to the factoring account.

- Final settlement: Upon receiving the remaining payment, deposit it into your bank account. The offsetting entry should again go to the factoring account.

Quit the guesswork and obtain top invoice factoring services in the UK with ComparedBusiness

ComparedBusiness links you with reliable invoice factoring providers in the UK. Just submit your requirements in less than 2 minutes and we will match you with them. Get ready to receive immediate payment for your outstanding invoices within 1-3 days.

FAQs

Yes, you can record multiple invoice factoring transactions simultaneously in your accounting software. Most platforms, like Quickbooks, allow batch processing of invoices and factoring entries.

Factoring itself is neither an asset nor a liability. However, the receivables sold in factoring are assets, and the advance received can create a liability if there’s a recourse agreement.

Invoice factoring is not considered debt. It involves receivables for immediate cash, meaning the business does not owe money back to the factor. However, if the agreement is recourse, there may be an obligation to repay if the customer fails to pay.