Let’s be honest. Clients take time to pay invoices, yet recruitment agencies still need to cover payroll, contractor fees and operational expenses on time. That’s where recruitment finance, steps in.

Recruitment invoice finance helps recruitment agencies maintain a steady cash flow and reduce the stress of waiting for clients to pay. By smoothing out cash flow, it also opens the door to taking on more clients and investing in business growth without risking cash shortages.

Want to take a deeper look?

What is recruitment invoice financing and how does it work?

Recruitment invoice financing provides a practical way for recruitment agencies to convert unpaid invoices into immediate working capital. In an industry where cash flow is essential to cover payroll, contractor fees and operational costs, recruitment invoice finance allows agencies to access funds long before clients pay their bills.

How does recruitment invoice financing work?

- Application and approval: After submitting an application the finance provider evaluates your agency’s outstanding recruitment invoices, focusing on the creditworthiness of your client base. If your clients are known to pay on time, it greatly improves your chances of approval and the terms offered.

- Advance of funds: Once approved, a significant portion of each recruitment invoice’s value (70%-90%) is advanced to you within days, normally. This immediate cash boost allows you to cover your crucial expenses.

- Client payment and settlement: When your client pays the recruitment invoice, the finance provider collects the payment, deducts their fees and transfers the remaining balance back to you. Alternatively, some recruitment invoice financing options allow your agency to manage the collection, which lets you maintain direct communication with clients.

Compare Invoice Financing Quotes Today

Why do recruitment agencies use invoice financing?

Recruitment agencies often work with clients who have lengthy payment terms. Result? A gap is created between invoicing and payment. This can stretch cash flow thin. With payroll obligations and operational expenses mounting, agencies need funds in the bank rather than locked up in unpaid invoices.

Invoice finance for recruitment fills this gap. Here are some reasons recruitment agencies leverage this option.

1. Managing payroll without delay

For recruitment agencies, especially those dealing with temporary or contract placements, paying staff on time is non-negotiable. Using recruitment invoice finance, agencies can confidently cover payroll without waiting for client payments, ensuring consistent operations.

2. Fueling growth and flexibility

Imagine having big opportunities on the horizon – new clients, expanded services or additional placements. Invoice financing gives agencies the cash to invest in these initiatives without needing traditional loans or debt.

By securing funds against receivables, they can quickly access working capital to achieve growth plans and execute a robust business plan without the constraint of slow-paying clients. This is one of the top reasons why businesses opt for factoring as well.

3. Protecting against client payment issues with insurance

Some invoice finance providers in the UK offer factoring with insurance. This is a feature that mitigates risks related to client payment delays or defaults. This added security means agencies can confidently take on larger clients, knowing that potential payment issues won’t disrupt cash flow or operational stability.

4. Supporting cash flow planning

With recruitment invoice financing, the agencies gain more predictability to allow them to manage expenses and cash flow with confidence. Knowing funds are available when needed offers peace of mind and enables better financial planning across the board.

Benefits of recruitment invoice finance for agencies

Invoice finance has become essential for recruitment agencies in the UK because it helps them scale when client payments are delayed but payroll can’t wait. Let’s look at some of the benefits of this financing method.

1. Reduced dependence on loans

Invoice financing is an alternative to traditional loans, which come with interest rates and fixed repayments. Because it’s not a loan, invoice financing involves no interest and that reduces the financial burden on growing agencies.

2. Strengthened client relationships

With steady cash flow from invoice financing, recruitment agencies can offer clients more flexible payment terms without impacting their own finances. This flexibility can lead to stronger client relationships and even longer-term contracts.

3. Enhanced competitive edge

Recruitment invoice finance empowers agencies to respond quickly to market demands, onboard contractors efficiently and expand services without waiting for client payments. This agility gives them an edge in a competitive field, enabling them to attract more clients.

4. Accelerated cash flow

Recruitment invoice finance gives agencies fast access to working capital. When clients have payment terms of 30, 60 or even 90 days, waiting for invoices to clear can feel like waiting for rain in a drought.

With invoice finance, agencies access funds against unpaid invoices to ensure timely payments to employees and contractors.

According to a 2023 Statista report, 15% of SMEs in the UK regard cash flow as their main obstacle in the next 12 months.

Types of recruitment finance options available

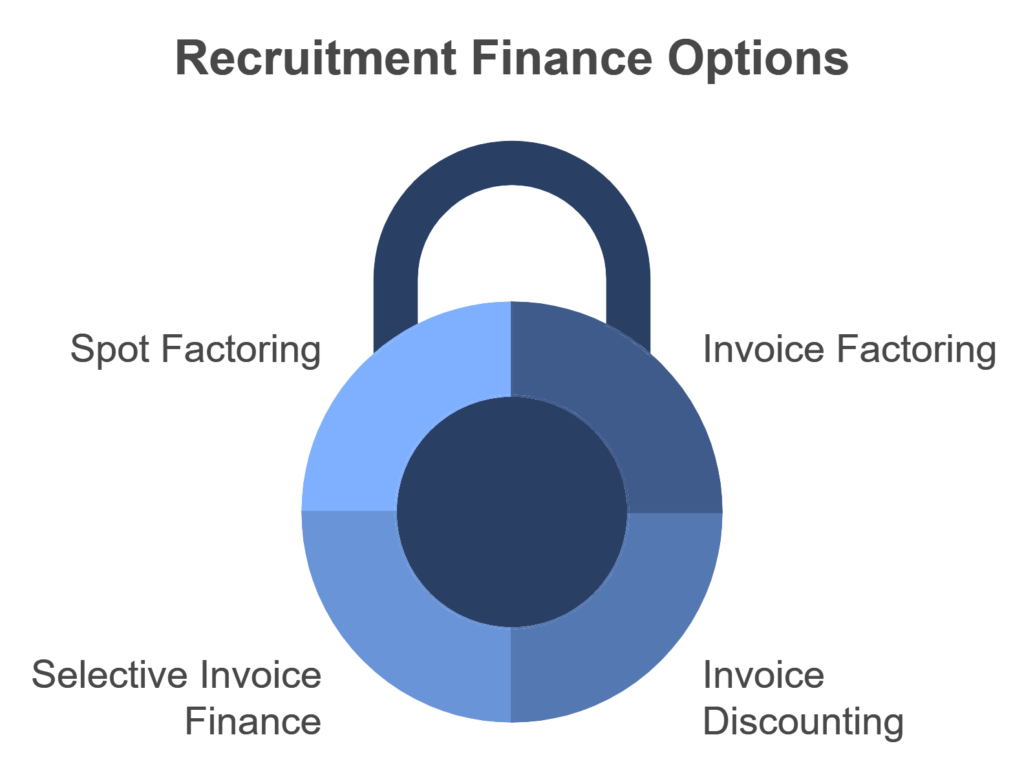

When it comes to recruitment finance, agencies have several options.

- Invoice factoring: In invoice factoring, the finance provider purchases your outstanding invoices and advances a percentage (70-90%) of the invoice value upfront. The factor then collects payments directly from the client, and once the invoice is paid, the remaining balance is paid to you.

- Invoice discounting: Invoice discounting allows you to maintain control over client relationships. Here, you still receive an advance on unpaid invoices, but you’re responsible for collecting payments from clients.

- Selective invoice finance: In this type of factoring, agencies can choose specific invoices to finance rather than financing all invoices.

- Spot factoring: Spot factoring is similar to selective invoice finance, but here, a single invoice is financed rather than a batch.

Get Secure Invoice Finance Services For Recruitment - Contact ComparedBusiness UK

Getting reliable recruitment invoice finance services in the UK is easy with ComparedBusiness. We provide you with invoice factoring and discounting services from top providers in the UK. Just submit your requirements in less than 2 minutes and we will match you with them.

FAQs

Invoice financing carries moderate risk, mostly if clients delay payments or default. This can disrupt cash flow. Some providers offer protection, though, like non-recourse options, but it’s vital to assess clients’ reliability and the provider’s terms to minimise risk.

Yes, recruitment invoice financing is often available to new agencies as long as they have invoices from creditworthy clients. Approval primarily depends on the payment reliability of your clients, so even startups in the recruitment industry can access this financing option.

Not necessarily. Many financing options offer non-notification agreements, which allow you to handle client communications directly. This lets you maintain client relationships and manage collections independently while still benefiting from the financing agreement.