There are many terms in the finance world that are often confused for their meaning and application. Reverse factoring vs supply chain finance is one popular example of that. In this article, we’ll throw the spotlight on this topic and clear the confusion around it.

What is reverse factoring?

Reverse factoring refers to a process through which suppliers receive early payment for their invoices at a reduced rate. It may seem the same as invoice factoring but the difference is that in invoice factoring, the transaction is initiated by the seller and in the case of reverse factoring, by the buyer.

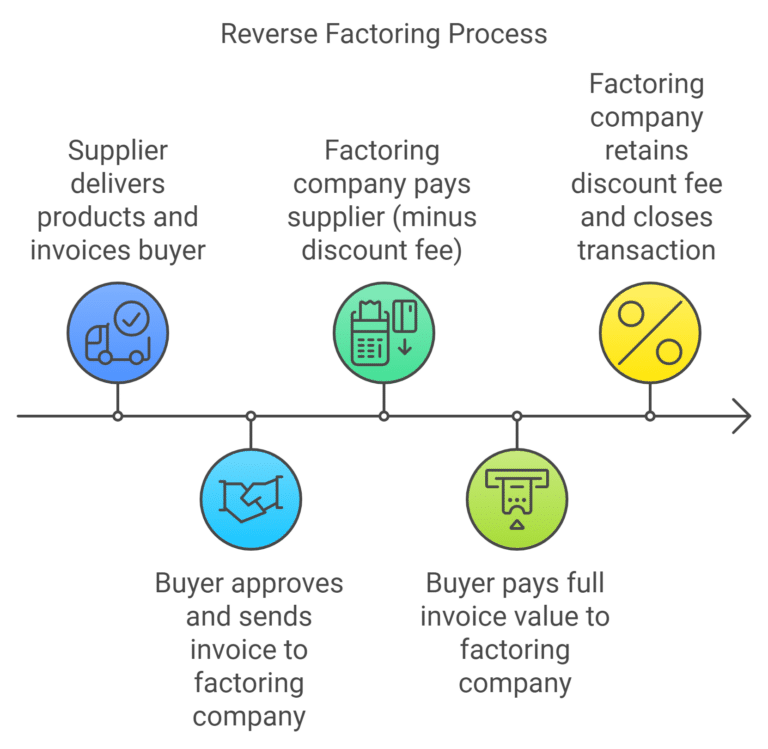

The process of reverse factoring is as follows:

- The supplier delivers the products to the buyer and issues an invoice.

- The buyer approves that invoice and sends it to the factoring company.

- The factoring company pays the supplier the value of the invoice, minus a discount fee. This payment is usually made within 1-2 days.

- On the due date, the buyer pays the full invoice value directly to the factoring company. The factoring company retains the discount fee and closes the transaction.

Compare Invoice Financing Quotes Today

Features of reverse factoring

- The financial institution (factoring company or bank) undertakes the transaction as an uncommitted facility.

- All the risks rely on the buyer as it’s only based on confirmed goods received.

- The financial institution pays 100% of the value of the invoice minus the discount fee.

- The supplier signs the receivable purchase agreement without recourse and takes payment off-balance sheet.

Reverse factoring vs supply chain finance: The difference

Now comes the main topic of this article – reverse factoring vs supply chain finance. Well, it’s not reasonable to differentiate both financial terms and here’s why.

Reverse factoring is actually a product within the broader ecosystem of supply chain finance. Supply chain finance encompasses various financial products designed to optimise cash flow across the supply chain. It includes not just reverse factoring, but also other financial tools such as:

- Receivables discounting: Suppliers sell their receivables to a financier at a discount before the due date to receive early payment.

- Factoring: Similar to receivables discounting, the transaction is generally initiated by the supplier rather than the buyer. The factoring company advances a percentage of the invoice value and collects payment from the buyer on the due date.

- Loan against inventory: This involves securing a loan based on the value of a company’s inventory. It allows businesses to access working capital without having to sell off inventory.

Now that we’ve understood the definition of supply chain finance, let’s go a bit deep into it in terms of benefits.

Benefits of supply chain financing for buyers

Supply chain financing provides a range of benefits to buyers, enhancing both their financial management and their relationships with suppliers. One of the most significant advantages is the ability to extend payment terms without negatively impacting suppliers’ cash flow. Through SCF, a financial institution steps in to pay the supplier early, which allows the buyer to delay their payments while the supplier receives immediate funds.

Additionally, it helps buyers maintain relationships with their suppliers. By ensuring that suppliers are paid promptly, buyers can foster trust and reliability, which can lead to better negotiation terms, discounts and even priority in supply.

Benefits of supply chain finance for sellers

Benefits for sellers include:

- Improved cash flow: Sellers receive advance payment for their invoices, which enhances cash flow and reduces the need to rely on traditional financing options like loans.

- Reduced payment uncertainty: Supply chain financing minimises the risk of delayed payments from buyers. This provides more predictable revenue streams and financial stability.

- Affordable costs: The cost of supply chain financing products like factoring is often lower than other forms of short-form borrowing. This makes it a more affordable option for sellers who want liquidity control.

- Strong buyer relationships: Supply chain financing usually includes good buyers in their ecosystem. By penetrating this ecosystem, sellers gain access to those buyers who pay on time and can develop good relations with them.

- Short documentation: The process of SCF typically involves less paperwork compared to traditional financing methods. This streamlined approach allows sellers to access funds quickly without being bogged down in lengthy documentation requirements.

- Flexibility: Sellers have the flexibility to choose which invoices they want to discount. They can decide to finance some or all of their receivables, depending on the cash flow needs.

Find top reverse factoring options in the UK with ComparedBusiness

ComparedBusiness provides you with secure invoice factoring & reverse factoring services from top providers in the UK. Just submit your requirements in less than 2 minutes and we will match you with them. You can choose the best option depending on your business needs. This service will cost you nothing.