Overview of merchant cash advance

A Merchant Cash Advance (MCA) is a smart, flexible funding solution for small and medium-sized businesses that rely on daily or weekly credit card sales. Instead of a traditional loan, you get fast access to cash in exchange for a percentage of your future sales, giving you the capital to grow without the wait.

How does a merchant cash advance work?

The difference between an MCA and traditional loans is that an MCA operates on a revenue-based repayment system, and the loan operates on fixed monthly instalments. The MCA lender provides a cash advance, and in return, they receive a fixed percentage of the business’s future credit card sales until the advance plus fees is repaid. This means that repayment fluctuates with the business’s cash flow – if sales are slower one day, the repayment is lower, and if the sales pick up, the repayment amount increases accordingly.

For example, if a restaurant receives a £50,000 MCA with a factor rate of 1.3, the business would need to repay £65,000 over time (50,000 x 1.3). If the agreed-upon holdback percentage is 10%, then 10% of the restaurant’s daily sales will be automatically deducted by the lender until the full amount is repaid.

How to qualify for a merchant cash advance?

Merchant funding is accessible to a wide range of UK businesses. That is because it typically has more lenient qualification standards compared to other financing options, which often place high importance on credit scores and history. Even a business with bad credit can access MCA funds within 24-48 hours.

Eligibility for MCA funding is typically focused on the sales volume of a business rather than its credit history. Here are the four basic requirements:

- Card payments enabled: The business must accept card transactions since cash-based sales are not considered in the case of merchant funding.

- Steady sales volume: The business must have a consistent volume of card transactions, which will determine its profitability. Each MCA provider has its own evaluation standards, but most require a minimum monthly revenue of at least £5,000.

- Business history: MCA lenders tend to associate less risk with businesses that have been operating for more than 3 years. This indicates stability and the business’s proficiency in financial management. However, businesses that have been operating for 6–12 months may still qualify.

- Minimal financial issues: Businesses with recent financial problems, like bankruptcies or MCA defaults, may find it difficult to qualify for an MCA.

Do you need a Merchant Cash Advance?

Current situation of MCA in the UK

The merchant cash advance industry in the UK has gained significant popularity over the years. The lender offers competitive rates and industry-specific terms to the relevant businesses.

MCA across different industries

Retail and hospitality: Business industries like restaurants, salons, and retail shops experience a fast-paced environment paired with seasonal fluctuations. Depending on trends, customer interests, and a higher supply, sales volume may also change, which could result in a cash flow shortage at some point. By using a merchant cash advance, they can optimise their cash cycle by paying less during lower sales volumes or invest in new equipment to prepare for busy seasons.

Digital businesses: Online businesses, including those operating on e-commerce platforms like Amazon and Shopify, are turning to MCA to grow their businesses. To better understand this, let us consider an example of an online shop that sells summer clothing. It earns most of its money between June and August and makes fewer sales in winter. The shop secures a merchant cash advance before its busy season for preparation. With no restriction on how to spend the funds, it can buy inventory, advertise on social media, and cover running costs. This means it pays more during the busy summer months and less when sales are slow in winter.

Benefits of MCA for businesses

There are clear reasons why more and more businesses are now choosing MCAs. One major reason is that they deliver certain benefits to each business, regardless of its industry or scale. Let us take a look at these advantages in detail.

- Quick access to advance funds: A merchant cash advance allows businesses to receive funds within 1-3 days after application. This short period gives MCA providers time to evaluate and analyse a business’s credibility and determine whether it qualifies for funding. The fast funding time makes it an ideal solution for companies that need same-day MCA access to cover urgent expenses.

- Flexible repayments: MCA repayments depend on a business’s daily or weekly sales, which means they vary according to the sales volume. This allows businesses to pay less during slower periods, so they are not obligated to pay fixed instalments.

- No requirement of collateral: Unlike bank loans, MCAs are unsecured. That is highly beneficial for businesses that may not have significant assets to leverage.

- No restriction on spending ways: MCA contracts typically do not have any restrictions on how the advance funds must be spent. The business has complete freedom to clear any type of expense.

Challenges facing the MCA industry

Despite their benefits, MCAs present a number of challenges. One big drawback is the high costs associated with the advances. Factor rates can result in significantly higher APRs for merchant cash advances than bank loans, often exceeding 50% to 100% or more.

Additionally, the lack of regulatory oversight in the MCA industry (it does not fall under the scope of the Financial Conduct Authority) compared to traditional financial services poses risks. In the UK, while some consumer protections exist, the same strict regulations seen with business loans do not always apply. Such circumstances can lead to predatory practices by some MCA providers, which might result in legal issues.

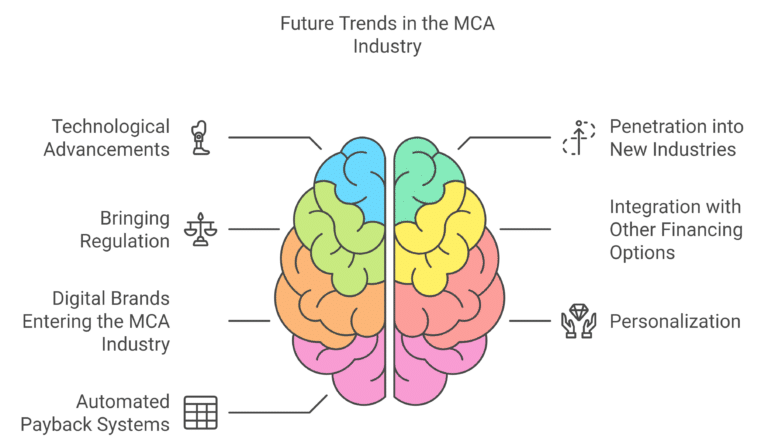

What is the future of merchant cash advances?

With the increasing trend of MCA, it is safe to say that the future of Merchant Cash Advance is promising.

1. Technological advancements

AI and machine learning are revolutionising the way MCAs are processed. These technologies will allow for faster and more accurate underwriting decisions by analysing large sets of data, including sales patterns and customer behaviour.

2. Penetration into new industries

Currently popular in retail and hospitality, MCA will see growth in other sectors like healthcare and service-based businesses in the UK as well. As businesses with fluctuating revenue streams look for flexible financing options, MCA will become more accessible to them.

3. Bringing regulation

One of the other future trends of the MCA industry is the journey towards regulation. Regulatory scrutiny is increasing in the UK to prevent negative practices by lenders. These regulations will focus on improving transparency around fees, terms and conditions. Result? Businesses will fully understand the cost of MCA.

4. Integration with other financing options

The future will see MCAs integrated with other financing tools, such as traditional loans and lines of credit. This will allow businesses to diversify their funding strategies based on their specific needs, combining short-term cash advances with longer-term financing to create a more balanced approach.

5. Digital brands entering the MCA industry

More digital platforms are entering the financing world. Shopify created Shopify Capital in 2016 to aid online customers in procuring financing. According to their 3rd quarter 2018 earnings report, they issued £58 million in MCA. It’s not just Shopify; fintech companies like Pipe are using digital processes to simplify application procedures, so this trend will only thrive in the coming years.

These platforms will offer user-friendly interfaces that will enable businesses to secure funding with just a few clicks.

6. Personalisation

MCA providers are moving towards tailored financing solutions using advanced data analytics to offer businesses funding options that are customised to their revenue cycles and cash flow needs. How cool that would be? You’d get a personalised plan according to your needs, just like a diet plan.

7. Automated payback systems

With the integration of POS systems and digital platforms, the MCA repayment process will become even more automated. These systems can seamlessly deduct a percentage of daily sales, eliminating manual payments and reducing administrative burden.

How to prepare for the future of merchant funding?

Businesses must adapt to these emerging trends to maximise their benefits while minimising risk.

- Leverage technology for efficiency: With digital platforms and automated payback systems becoming more prevalent, businesses should invest in different types of POS systems and software that seamlessly integrate with MCA systems. By automating repayments based on daily sales, businesses can avoid manual tracking and ensure timely payments.

- Diversify financing options: While MCAs provide flexible and fast capital, they often come at a higher cost compared to bank loans. Businesses should consider integrating MCAs with other financing solutions such as short-term loans, lines of credit and invoice finance.

- Build cash flow buffers: Your business should focus on building cash flow buffers during high-revenue periods. This can help minimise the need for extensive MCAs during slower months. By setting aside profits during peak seasons, your business can rely on the internal reserves for operational expenses.

- Adopt personalisation in financial management: With MCAs increasingly moving towards personalised financing, your business should use data-driven tools to assess your own sales patterns and cash flow needs. By analysing these patterns, you can tailor your financial approach to match the revenue cycle.

Take full advantage of these MCA future trends with ComparedBusiness UK

We at ComparedBusiness UK can help you secure merchant cash advance funding from the top vendors in the UK. Just submit your requirements in less than 2 minutes, and we will match you with the financial institutions in the UK that are already working according to these trends. You can pick and choose the best option as per your business requirements.

FAQs

Yes, you can repay an MCA early, but it may not save you any money. MCAs use a factor rate, meaning the total repayment is fixed. Some MCA providers also charge early repayment fees, so always check the terms before proceeding.

Yes, many MCA providers offer same-day funding, but this depends on the provider and the completeness of your application. If approved, businesses can typically receive funds within 1-2 days.

To qualify for a Merchant Cash Advance, your business typically needs consistent credit or debit card sales, usually around £5,000-£10,000 monthly. Other factors include having an operational history of at least 6-12 months and showing stable cash flow.

Yes, it’s possible to obtain an MCA with a bad credit rating. MCAs are primarily based on the sales performance and profitability of your business rather than your credit score.