What is invoice factoring?

Invoice factoring (also known as debt factoring or simply factoring) is a financial solution utilised by various types of businesses, including staffing companies, to efficiently manage cash flow gaps by acquiring instant cash in exchange for selling unpaid invoices. Typically, the funds provided by a factoring company consist of 70%- 90% of the total value of the invoices sold.

Why Staffing companies sell receivables?

Staffing companies choose to sell their receivables for several reasons. Here are some of the main ones.

- Immediate cash flow: Businesses often face cash flow challenges, especially when dealing with low-paying customers/clients. Selling receivables provides immediate access to funds, enabling them to meet payroll, purchase inventory and cover other operational expenses.

- Risk management: By selling receivables, businesses can transfer the risk of non-payment to the factoring company.

- Business growth: Businesses looking to grow or invest in new opportunities may not have the luxury of waiting 30, 60 or 90 days for invoice payments. Selling receivables for cash allows them to reinvest in the business more quickly which fuels their growth.

In this process, 3 key parties are involved. We will discuss the role of each to understand how invoice factoring works for a staffing company.

Compare Invoice Financing Quotes Today

3 key concepts involved in factoring for staffing companies

In this process, 3 key parties are involved. We will discuss the role of each to understand how invoice factoring works for a staffing company.

1. The staffing company:

A staffing or recruiting company is a labour supply business that hires part-time or full-time employees to other firms (which are the customers for the staffing company). In the context of invoice factoring, the staffing company becomes the client for the factoring company and is the one to initiate the process.

2. The staffing company’s clients:

The clients of the staffing company receive services to easily hire employees without going through the recruiting process themselves. They’re responsible for paying the invoices issued by their supplier (which is the staffing company). After the invoices are sold, the clients will continue to fulfil invoice payments directly to the factoring company as if they would to the staffing company.

3.The factoring company:

The factoring company purchases unpaid invoices from the staffing company and provides an initial cash advance. The staffing company uses the funds to sort out crucial expenses, pay employees and resume business operations. After the contract is in place, the factoring company collects the payments of due invoices directly from the staffing company’s clients. After all the invoices are cleared, the factoring company releases the remaining balance (10%- 30% of the invoice value) to the staffing company minus a factoring fee for its services.

According to a report by Invoice Funding, business payment cycles have been shown to at around 45 days in 2022.

How to qualify for invoice factoring as a staffing company?

A staffing firm must meet the following set of criteria to qualify for invoice factoring:

- Factoring companies do not assess the risk of non-payment in the same way traditional lenders do. Instead of performing credit checks and evaluating the credit score of the staffing company, they assess the creditworthiness of its customers. This means that the company should have clients with strong payment histories, which proves their ability to pay the pending invoices.

- Some factoring companies only work with a staffing company under the condition of factoring a minimum number of invoices. Make sure you understand the terms and conditions of the factoring company you are working with to increase your chances of qualifying for the service.

· A staffing company should sell the invoices only after the services are delivered, with payment being the last remaining step. This is because factoring companies typically do not advance funds to unfulfilled services. - A clean financial record, without significant legal disputes, also strengthens the company’s position as a trustworthy partner.

3 reasons why staffing companies use invoice factoring

Let us discuss three primary reasons why staffing companies in the UK use invoice factoring:

1. Disparity between cash inflow and outflow: A core problem that staffing companies face is the mismatch between the outflow and inflow of cash. Often, staffing companies pay their employees on a daily, weekly or monthly basis, but get paid by their clients on a contract basis that can stretch from 30 to 90 days or longer, depending on the agreement.

2. Late payments: Late payments are common even with reliable clients, which adds to the financial pressure for staffing companies.

3. Competition within the industry: The high competition in the staffing industry requires companies to continually improve to remain relevant to both existing and new clients. To achieve this, staffing firms need a consistent working capital, which is often tied up in unpaid invoices.

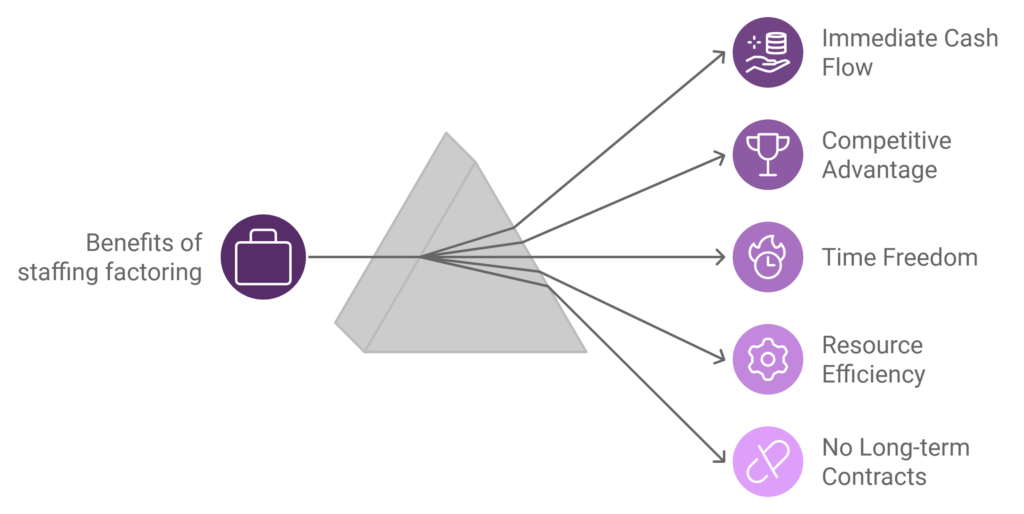

Benefits of staffing factoring

Staffing companies can use invoice factoring in the following five ways:

1. Access to instant cash:

With invoice factoring, staffing companies sell their unpaid invoices and get access to 70% to 90% of the invoice value at once. This eliminates the need to wait on clients’ payments for months, as the factoring company takes over the collection process in exchange for a factoring fee. The extra cash allows staffing companies to pay their employees on time, take on new projects and cover other business expenses without relying on traditional bank loans, which could hurt the business’s credit score.

2. No need for traditional loans:

Invoice factoring does not appear as debt on a business’s records, unlike bank loans. This is because the business is simply selling its accounts receivable, which is something it already owns, rather than borrowing money from a third party. Another major difference is that invoice factoring usually comes with fewer terms and doesn’t require collateral as compared to a bank loan.

3. Access to ample resources:

Since it’s the factoring company that looks after getting payments from the clients of the staffing companies, the staffing company can be freed from the time and money spent on chasing payments.

They can focus on other parts of the business like marketing and customer service without taking on the stress of unpaid invoices.

4. Helps to gain a competitive advantage:

We discussed the competition as one of the challenges for staffing companies above. Well, with reliable cash flow and the ability to offer flexible payment terms to clients, staffing agencies can gain a competitive edge in the market.

Think about it. If they get the ability to pay staff on time and take on new contracts, wouldn’t they crush their competition? That’s what factoring enables.

5. No long-term contracts:

Most factoring arrangements are flexible and don’t require long-term commitments. This allows staffing agencies to use factoring as needed, scaling up or down based on their current financial situation.

Invoice factoring vs other financing options for staffing companies

Invoice factoring is not the only method of financing available for staffing companies. There are several others, but how do they compare with factoring? Let’s have a brief look.

1. Business loans

Traditional business loans allow staffing agencies to borrow a lump sum from a bank, repaying it over time with interest. While this method provides access to significant capital, it comes with strict credit requirements, long approval processes and the burden of debt that keeps increasing with every passing year.

In contrast, invoice factoring offers quicker access to cash without adding debt to the balance sheet.

2. Overdraft facilities

An overdraft facility allows companies to withdraw more money from their bank account than is available, up to an agreed amount. This can provide short-term relief for cash flow issues, however, overdrafts often come with a high interest rate and fees.

Compared to invoice factoring, which provides funding based on receivables, overdrafts are less predictable and can lead to significant costs if not managed carefully.

3. Asset-based lending

Asset-based lending involves borrowing against the value of a company’s assets, such as inventory or equipment. ABL can offer higher funding limits than invoice factoring, as it considers multiple asset types. However, it requires complex arrangements and ongoing asset valuations.

Invoice factoring is more straightforward, with funding directly tied to accounts receivable.

What to look for in a factoring company for staffing agencies?

Let’s be honest – not all factoring companies are equal. Some are great while others will stress you out even more. Here are a few considerations for choosing a good factoring company:

- Industry experience: Choose a factor with proven experience in the staffing industry, An understanding of unique challenges and cash flow cycles in staffing is essential in order to provide effective services.

- Advance rates: Analyse the advance rates offered by different factoring companies. Higher advance rates do mean more cash, but make sure to balance this with other terms. For example, if a factor advances 90% but charges 6% free, it’s worse than a factor advancing 75% and charging 3% fee.

- Contract terms: Review the length and flexibility of the contract. Some companies offer long-term contracts while others have flexible ones. Choose the one that sits well with your business needs.

- Customer support: Reliable and responsive customer support is crucial. Ensure the factoring company provides excellent service, as you may need assistance with various aspects.

- Technological advancement: Look for a factor that offers modern technology solutions such as online account management. This improves the efficiency of the process.

Staffing factoring costs

When staffing companies opt for invoice factoring, it’s important to understand the costs of factoring to ensure the service aligns with their financial needs. Generally, they can be divided into 2 parts.

- Factoring fee: The factoring fee typically ranges between 1% and 5% of the invoice value. This fee depends on several factors, including the creditworthiness of the company’s clients, the total volume of invoices being factored and the time it takes for clients to pay the invoices, etc.

- Additional fees: Some factoring companies may also charge for additional services such as setup fees and monthly minimum fees. Thus, it’s crucial for you to review the staffing factoring contract carefully and understand all potential costs involved.

Get linked to top staffing factoring options in the UK with ComparedBusiness UK.

ComparedBusiness UK links you with top factoring companies that provide staffing factoring services in the UK. Just submit your requirements in less than 2 minutes, and we will match you with them. You can choose the best option depending on your business needs.

Factoring in staffing involves selling unpaid invoices to a factoring company in exchange for immediate cash. This helps staffing agencies maintain steady cash flow, pay employees and cover operational expenses but it comes at the cost of a factor fee.

The average cost of factoring invoices typically ranges from 1% to 5% of the invoice value. The exact rate depends on factors such as the industry, the creditworthiness of your customers and the volumes of invoices.

Factoring companies typically pay within 24 to 48 hours after receiving and approving the invoices. Some companies may also offer same-day funding, depending on the agreement.