If you’ve ever asked, “What is chip and PIN?’ or “What does chip and PIN mean?”, you’re not alone. It’s a term that’s become part of our daily lives, but it’s worth understanding how this technology works and why it’s essential for businesses today.

What does chip and PIN mean?

Simply put, chip and PIN technology is a secure way to process card payments using a microchip embedded in the card and a Personal Identification Number (PIN). Instead of the traditional swipe-and-sign method, the chip encrypts your transaction details, and the PIN confirms your identity, ensuring a high level of security.

But why has it become important? Well, the old magnetic strip technology was far more vulnerable to cloning and fraud. The chip in your card generates a unique transaction code each time it’s used, making it significantly harder for criminals to copy.

According to a report by Money.co.uk in 2022, 1.7 billion debit and credit card transactions were made by UK cardholders in January 2022 alone.

Compare Card Machine Quotes Today

How does chip and PIN work?

So how does a chip and PIN transaction work, and what’s happening behind the scenes when your customer makes a payment?

The chip: Your data guardian

The chip refers to a small microchip embedded in the customer’s debit or credit card. This chip is like a tiny vault of encrypted data. When the card is inserted into any type of PDQ machine, the chip generates a unique transaction code that cannot be reused. This makes it much harder for fraudsters to copy or clone the card, unlike the old magnetic strip system.

The PIN: Your digital signature

PIN is a four-digit Personal Identification Number that the customer enters to confirm their identity. Think of it as a digital signature. The PIN adds an extra layer of security by verifying that the person using the card is indeed the cardholder.

Now, why is it important? Imagine a stolen card. Without the PIN, it’s incredibly hard for a thief to complete a purchase, which wasn’t the case with signature-based payments.

The transaction flow: How it all comes together

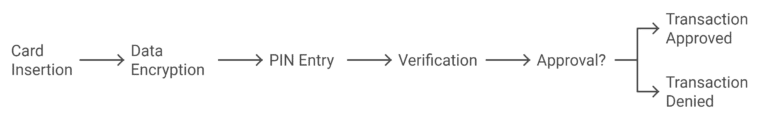

- Card insertion: The customer inserts their card into the chip reader.

- Data encryption: The microchip generates a unique transaction code and sends the encrypted data to the payment terminal.

- PIN entry: The customer enters their PIN, which verifies their identity.

- Verification: The payment terminal sends the encrypted transaction data to the bank or payment processor.

- Approval or denial: The bank checks whether the customer has enough funds, and if everything checks out, the transaction is approved. The bank sends the approval back to the terminal, which completes the transaction.

Benefits of Chip and PIN for business

If you’re accepting debit and credit card payments as a business, you’re always looking forward to making things smoother. Chip and PIN supports you in that.

1. Reduced fraud risk

One of the biggest advantages of using a chip and PIN payment system is the significant reduction in fraud. Because the chip encrypts every transaction and the PIN verifies the customer’s identity, it’s much harder for criminals to exploit.

2. Increased customer confidence

Today’s customers are using cards for payment a lot. And they’re more conscious about the safety of their financial data. When they see that your business uses a chip and PIN reader, it reassures them that their payment information is safe.

This level of trust makes all the difference, especially when trying to build long-term relationships with your customers.

3. Faster and efficient transactions

If you’re accepting POS and phone payments through cards, having a chip and PIN setup can make the process quick and seamless. Once customers are familiar with inserting their card and entering their PIN, transactions move faster than older methods like signing receipts. For businesses handling large volumes of customers, especially during peak hours, this speed is invaluable.

4. Improved cash flow

With chip and PIN systems, payments are processed in real-time, meaning the funds reach your account faster than with older payment methods. This can help smooth out cash flow, allowing you to better manage your business’s financial health.

How chip and PIN machines work for businesses?

Now that we’ve covered the basics, let’s take a closer look at how chip and PIN machines will work in your business setting. How does it connect to banks and ensure secure payments? Let’s break it down.

1. The hardware: Chip and PIN terminals

The first thing to know is that chip and PIN or PDQ machines come in different shapes and sizes, depending on your business needs. Whether it’s a countertop model for a shop, a portable device for restaurants, or even a mobile unit for businesses on the go, these machines are all designed to process chip and PIN payment transactions efficiently.

2. Processing payments in real-time

When your customer inserts their card into the chip and PIN machine, the terminal starts communicating with your payment processor. The chip on the card generates a unique code and the machine sends encrypted payment data to the customer’s bank for authorisation.

This happens in real-time within seconds. The bank checks whether the customer has sufficient funds and if yes, the transaction is approved. You, as a business owner, get confirmation on your screen and the funds start moving toward your merchant account.

3. Integration with POS systems

Most chip and PIN machines integrate seamlessly with your point-of-sale (POS) system. This means every time you process a chip and PIN payment, your terminal automatically updates your POS, deducting the transaction from your inventory and updating your daily sales.

4. Choosing the right machine

When deciding which chip and PIN machine to choose, businesses need to consider a few things:

- Cost: Some machines have upfront costs, while others might come with monthly rental fees.

- Mobility: If you’re a mobile business, you’ll want a device that works on the go, like one that connects to WiFi or mobile networks.

- Transaction fees: Different providers offer different transaction fees, typically ranging between 1-3% per payment.

The future of chip and PIN: What’s next?

As technology evolves, so does the way we pay. While chip and PIN technology has been the gold standard for secure payments in the UK for the past few years, you might be wondering: what’s next?

1. The rise of contactless payments

We’ve seen it – more and more customers are opting for contactless payments in the UK.

It’s faster and more convenient, especially for small purchases. But where does this leave chip and PIN?

Well, chip and PIN readers aren’t going away anytime soon. While contactless is great for smaller transactions, chip and PIN still rules for purchases over £100. When it comes to higher-value transactions, customers still need the added layer of security that comes with entering a PIN.

According to a report by UK Finance, 83% of people in the UK now use contactless payments.

2. Biometric authentication

We’re heading into a future where even the PIN might be replaced with biometric authentication – things like fingerprints, facial recognition, or even voice recognition. Imagine making a chip and PIN payment but instead of entering your PIN, you simply press your thumb on the reader.

Some banks and tech companies are already experimenting with biometric cards that use your fingerprint for verification. While this is still in the trial phase, it could very well be the next leap in payment security.

3. Enhanced security regulations

As we move towards a more digital future, security regulations will tighten. Businesses in the UK are already required to meet the Payment Card Industry Data Security Standards (PCI DSS), and these standards will continue to evolve alongside new technologies.

In addition, the introduction of Strong Customer Authentication (SCA) regulations, which add depth to secure online transactions, shows how seriously security is being taken.

Need Chip and PIN readers for your business? ComparedBusiness can help you

We at ComparedBusiness have a database of top card machine vendors in the UK. Just submit your business requirements for card machines in less than 2 minutes and we will get back to you with detailed quotes from them. You can pick and choose the best option for your business.

FAQs

Chip and PIN is a secure method where the card’s microchip encrypts transaction data, and the customer enters a Personal Identification Number to verify the payment. It’s used to protect against fraudulent activities.

Yes, chip and PIN payments are more secure for higher-value transactions. Contactless is limited to smaller purchases, typically under £100, while chip and PIN requires a PIN for verification, which provides extra protection during transactions.

If a customer forgets their PIN, the payment will be declined after a few incorrect tries. They may need to contact their bank and reset their PIN or use alternative payment methods, such as mobile payments, if the transaction value is low.